Why the VAT registration threshold matters before your UAE free zone launch

It is often found that entrepreneurs are unsure of VAT registration threshold and its impact on their financial decision.

Is this happening with you while launching your free zone business?

Based on a business taxable supply, VAT threshold support in determining the registration details applicable on free zone business.

Free zone businesses with support of VAT registration can get business planning, compliance factor, budgeting and achieve penalty avoidance.

For your business to get this clarity is important at the very pre-startup stage that can assure you a smooth financial operation.

Understanding VAT registration threshold in UAE free zone

Once you learn about the statistics and concept of VAT registration threshold, you definitely will get to know about registering your VAT for your freezone business.

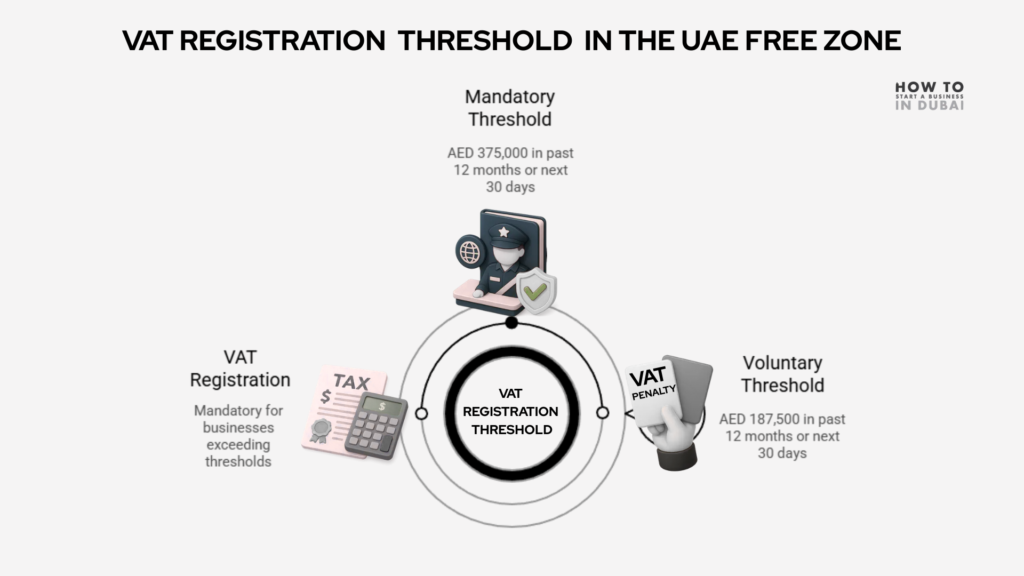

- VAT threshold is mandatory at AED 375,000. It indicates that if your imports and taxable supplies are exceeding this valuation in the previous 12 months or if you have a target of exceeding that value in the next 30 days then you must get a VAT registration.

- The same goes in case of a voluntary threshold where taxable expense if exceeding AED 187,500 in the past 12 months or in the next 30 days then also a VAT registration is mandatory.

- Free zone companies like FZE, FZCO or other branches are majorly treated in the same way as mainland businesses to achieve VAT registration unless they meet special conditions or operate under a designated zone.

Pro tip: Here is one pre-startup advice for you, if the projection exceeds AED 187,500 then consider it for voluntary registration or consider it for mandatory registration in case of valuation exceeding AED 375,000.

How does VAT registration impact the free zone business model right before the beginning?

You might have heard that many entrepreneurs do not get enough time to observe that their free zone business hit the VAT registration threshold without giving any warning.

Do you experience the same? Often high-volume business models like tech-services, consultancy, e-commerce and import-export business reach the VAT registration threshold quickly.

Here is a table that can help you find your business model and its associated threshold risk level.

| Business model | Threshold risk level | Cause of Fast rise |

| E-commerce | Very high | Frequent transactions. |

| Consultancy | High | High billing value. |

| Import-export | Very high | Larger trade volumes. |

| Tech-services | High | Recurring contracts. |

Also learn about business setup in the UAE even if you are employed in the UAE.

Necessary documents, timelines and pre-launch preparation for meeting VAT registration threshold in the freezone UAE

This is why we believe in sharing with you pre-launch preparation to understand necessary documents and the timelines associated.

| Category | Current requirements (2025 Update) |

| Mandatory documents | Mandatory documents like trade license, Emirates ID, passport and authorized signatoryBank account letter, revenue evidence, business activity and flexi-desk or office lease agreement. |

| VAT Registration timeline | For taxable supplies worth AED 375,000 of 12 months mandatory threshold. FTA approval requires 10 to 20 business days for complete submission. |

| Pre-launch preparation | Creation of Emara tax account, setting up accounting structure for revenue tracking and preparation of VAT compliance. Understanding reverse charge rules necessary for import-heavy free zones. Maintenance of a document folder for quick submission. |

| Common startup mistakes | Wrong calculation of the revenue, missing documents and ignoring the voluntary threshold Improperly tracking the imports in reverse charge. Also, there are penalties due to late registration. |

Learn about co-working and flexi-desk facilities to ensure your pre-launch conditions.

Avoid Penalties: Compliance for free zone startups to determine VAT registration threshold

It is important to stay compliant with VAT registration threshold as missing can lead to penalties through FTA due to incorrect filing and delayed registration.

- Once your business crosses the VAT registration threshold late submission can lead to AED 10,000 penalty.

- VAT returns due to late filing can lead to AED 1000 penalty for first offence and if done repeatedly within 24 months can lead to AED 2000 fine.

- Failing to maintain proper invoices can also lead to AED 10,000 fine.

- Late VAT payment can cost 2% of the unpaid tax along with additional penalties for late payment.

Possible mitigations

- Tracking revenue monthly: Regular comparison of taxable supplies detecting VAT registration threshold of AED 375,000.

- Classification and segmentation of the supplies: Properly distinguishing taxable and non-taxable supplies in order to avoid the miscalculation.

- Accurate bookkeeping and full maintenance: Import records, contracts and invoices can help you get ready for the VAT filings.

- Register promptly: Promptly registering on the FTA portal can help to get a safe approach to meet the threshold.

- Automate alerts: Utilising accounting software can help to get notification, once the revenue reaches the VAT registration threshold.

Advantages of VAT registration threshold planning before launching UAE free zone business

Here you learnt about the significance of determining VAT registration threshold for your UAE freezone business.

Now learn advantages that you will get through VAT registration threshold at your pre-startup level

| Area | Strategic advantage |

| Pricing strategy | Proper VAT inclusive pricing, trust building and prevention of marginal loss. |

| Investor confidence | Compliance development, risk minimization and strengthening of due diligence. |

| Financial forecasting | Cash flow prediction, VAT outflows budget and EBITDA clarity. |

| Operational kick-off | VAT invoicing, delay avoidance and smooth registration. |

| Voluntary registration | Corporate client attraction, credibility and tax recovery. |

| Scale up and growth | Export compliance, cross-zone expansion and supplier trust. |

| Regulatory works 2026 | Reverse charge readiness, penalty avoidance and FTA updates. |

Conclusion

Finally, you have learnt about the VAT registration threshold at your pre-startup business level. This can help you understand revenue forecast, pricing strategy, compliance as well as VAT recovery method.

Now is the time for you to take early preparation in order to prevent your freezone business from penalties and build credibility alongside scalability in the competitive market.

Need professional support?

Connect with us and get to assess document preparation, project revenue alongside registration of your Emara Tax before launching your business in the UAE free zone.

FAQs

Q1. What is the mandatory VAT registration threshold in the UAE free zone?

Once the tax supplies cross AED 375000 over a 12 months period, it creates VAT registrations threshold for your UAE free zone business.

Q2. Is it possible for a startup to register voluntarily before reaching a threshold?

Yes crossing a threshold of AED 187,500 allows you credibility and tax recovery that leads to registration voluntarily for your UAE free zone business.

Q3. What are the necessary documents for VAT registration?

Necessary documents for VAT registration are revenue evidence, business activity, Bank letter, Emirates ID, trade license and passport.

Q4. How soon VAT registration needs to be completed once it crosses the threshold?

VAT registration must be completed within 30 days of exceeding the threshold amount.

Q5. What is the average penalty regarding non-compliance?

The average penalty is about AED 10,000 for late VAT filings and non-compliance.

Do you need help in business setup or looking to start a business in Dubai? Here you will find all the information and business ideas you need for starting your own company in Dubai.

Leave a reply