Imagine your couch as the chairman seat, your hall room as the assembly and your cupboards as logistics — funny but real.

This read is all about introducing the Home Based Business License in Dubai, making it possible to launch your business legally from the comfort of your own space. For the entrepreneurs residing in Dubai, fancy office expenses are not letting everyone start their business.

Well, it’s time for the solution — as now you can look at your home space as one ideal headquarter of your business startup.

In 2026, progressive licensing rules in Dubai are creating opportunities for freelancers, creators and entrepreneurs to operate freely and enjoy utmost business privilege.

This read will take you through the concept, legal approach, supportive policies and all the virtual license solutions that you require to establish and run your home-based business in Dubai.

What is the concept of: Home Based Business License in Dubai?

Entrepreneurs running their business with office space will never believe the home-based business concept in Dubai. You might still question — is it official in Dubai?

The answer is Yes;

Dubai is now providing freelancers and entrepreneurs legal facilities to operate their business through their residence.

This approach is best for consultants, e-commerce owners and digital creators who prefer flexible setup at a low-cost investment.

Guess what? Dubai’s Department of Economic Development (DED) is responsibly supporting this trend.

You may visit POA in Dubai guide for complete insight.

Legal approach to run a home based business in Dubai

Do not even think of running your home-based business without a license in Dubai. And why do so when already Dubai is rewarding the compliance followers? Yes, it is true.

Now you can run your home-based business in Dubai legally with valid permit for mainland residence through DED eTrader license and for professional non-resident entrepreneurs through free zone freelance permit.

These licenses responsibly ensure your home-based business operations with official recognition in Dubai.

Your specific eTrader license or freelance permit in your particular zone provide you facilities of contract signing, online service promotion and business bank account setup.

For more specific insight, visit Dubai online business setup guide.

Evolving rules and supportive policies for work from home in Dubai?

Imagine a pandemic trend that became an option in the entire world but you utilising it as a permanent business model in Dubai — quite powerful, isn’t it?

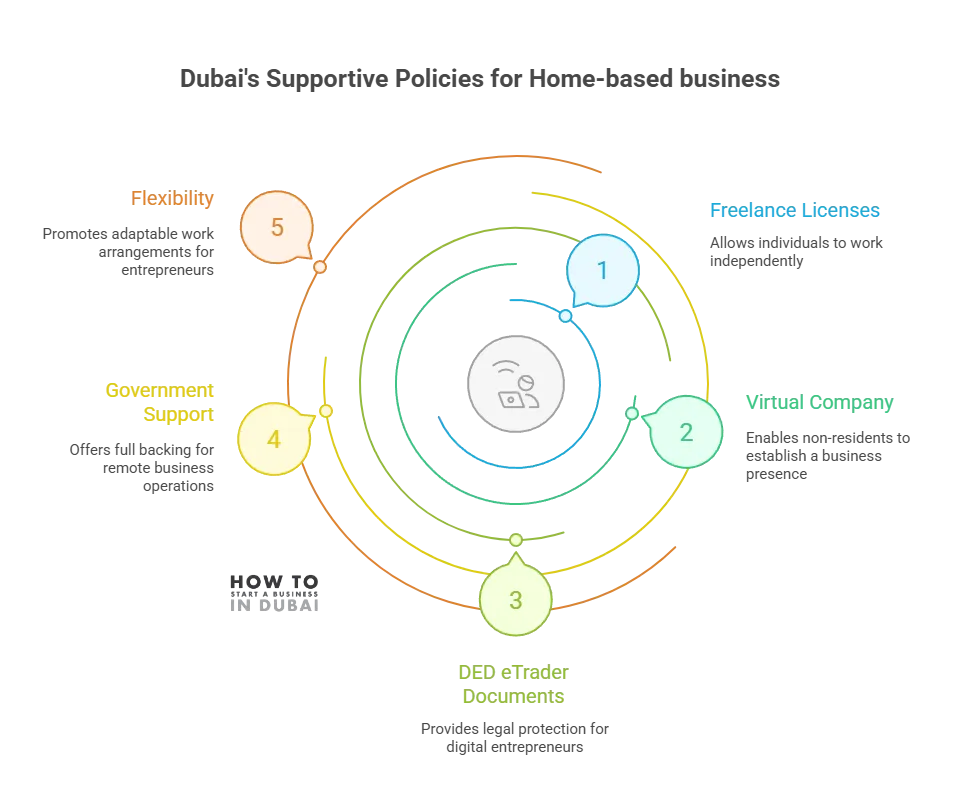

You absolutely will experience full support from the UAE government, once you get your freelance licenses, virtual company and DED eTrader documents to run your remote and home-based business in Dubai.

These initiatives provide legal protection for digital entrepreneurship and promote flexibility for both residential and global entrepreneurs in Dubai.

Here is one quick breakdown of your eligibility and required support-policies that can shape up your home-based business in Dubai:

| License type | Eligibility | Approximate cost in AED | Authority |

| DED eTrader License | UAE residents | 1050 | Dubai DED |

| Freelance permit | Expats and residents | 7,500 to 15,000 | Free Zone |

| Virtual company license | Non-residents | 850 to 1,500 | Dubai Economy |

Get more updates on the Dubai business setup guide.

Virtual license solution: Running business in Dubai without living there

The UAE government has completely broken the Global rule of doing a business only by living in the target market. In the case of Dubai, it has gone borderless.

Yes, you read it right. Now, the virtual company license is providing permits for international entrepreneurs to smoothly run their home-based business in the UAE remotely.

The virtual license solution is very ideal for consultants, digital service and freelance providers. Here are some key highlights —

- You can run your home-based business 100% online in Dubai, even from your home country.

- You can easily register your business on Dubai Economy’s official platform.

- Virtual license solution is approved for over 100 nationalities globally.

- Business activities comprise e-commerce, consulting and digital marketing under virtual license solution.

- The annual cost will be only chargeable between AED 850 to a maximum of AED 1500 only.

It’s smart and exciting — am I right? Get your virtual business at Dubai Virtual License Portal.

Practical guidelines for using home as your office in Dubai

It’s time for you to feel yourself sitting on the chairman couch at your sweet home — sounds luxurious. It is possible if you follow these golden rules to establish your home-based business in Dubai.

Finally, home-based business in Dubai is legal and so is your turn to fulfill specific requirements to do it right:

- Permission first: At first, you need one approved agreement with your property developer or landlord for conversion of your residence into workspace.

- Right license: For free zones you require a freelance permit for service-based professions and for social media based online sellers it requires a DED eTrader license.

- Compliance matters: Do not deliver any office signage or host client meetings without authority consent.

- Stay residential: It should be your responsibility to ensure no community rule violation or disturbance to neighbors, otherwise it will lead to great penalties.

- Legal protection: With legal protection, a valid license can assure contract deliverance, income generation and tax compliance under UAE law.

Explore the detailed setup guidance on the UAE Business Licensing Guide official page.

Advantages and disadvantages of Home Based Business License in Dubai Becoming your own boss from your home comfort — sounds smart.

But it is possible only when you get a clear update of advantages and disadvantages of the home—based businesses in Dubai.

| Advantages | Disadvantages |

| Low startup cost as just for minimal investment you can start your own home-based business in Dubai. | Not all businesses are eligible for home-based licensing. |

| There is no deadline pressure as you can start with flexible working hours which is ideal for side hustlers, parents and freelancers. | No client visit is permitted for home-based businesses. Also, no permit for traffic signage is allowed. |

| You can achieve legal recognition under freelance permit or DED eTrader based on business activity. | Based on the Authority under which your business lies will decide your license renewal cost. |

| You can enjoy tax-free income even in a home-based business in Dubai. | Business scaling is limited as for larger operations you ultimately will require commercial office space. |

| You can utilize digital ecosystem for seamless e-payment on online business platforms. | Due to zoning restrictions, some areas are prohibited entirely for business activity and for that you will require special approvals to run your home-based business. |

You probably learned the pros and cons – It’s now your turn for decision making.

Conclusion

It seems like you regularly visit us — or you will continue from now onwards. Well what matters more is your interest in home-based business and that too in Dubai.

Perhaps, if you are planning for a home-based business in Dubai, you must be someone ahead of entrepreneurs struggling for an office space in Dubai.

If you find this information interesting and you want more to get your home-based business established soon in Dubai then — Congrats, your wish has been fulfilled!

Just Click 👉 Contact Us and get your fruitful consultation with us, cause you worth it.

FAQs

Q1. What legal documents do I need to run my business from home in Dubai?

A. You will require a freelance permit for running service business in a freezone area whereas in the mainland region for your home-based business you will require a DED eTrader license.

Q2. Is it permissible to carry one home-based business in Dubai?

A. Yes, Dubai now legally supports remote working facilities and home-based businesses with a freelance licensing system.

Q3. Is it possible to run a home-based business in Dubai without living there?

A. Absolutely yes, the virtual company license permits any non-residential in Dubai to run their business online.

Q4. From whom I shall take permission to turn my Dubai-based home into a workspace?

A. Permission shall be taken from community approval or landlord in terms of business license compliance for running home-based business in Dubai.

Q5. What is the cost of a home-based business license in Dubai?

A. The home-based business license in Dubai ranges from AED 1,050 to AED 15,000 depending on license type and activity required.

Do you need help in business setup or looking to start a business in Dubai? Here you will find all the information and business ideas you need for starting your own company in Dubai.

Leave a reply