In Germany, the world’s most ambitious entrepreneurs are emerging, especially youth with new expertise and business ideas. In-demand European expertise, fast business registration and tax friendly ecosystems in Dubai are now welcoming German founders to start company in Dubai from Germany. “Warum nicht dorthin gehen, wo Chancen explodieren?!”

Let’s explore lifestyle advantages, opportunities, cost and compliance that can suit more to start company in Dubai from Germany.

Opportunities to start company in Dubai from Germany

Imagine your German business vision becoming a global success in a few years — this is what Dubai is waiting for you! For your German business vision, you can get 0% personal tax, access to a huge customer base and a complete profit repatriation across Asia, Africa and Middle East.

There is a connection between the German business region and its orientation in the Dubai market “Qualität aus Deutschland”. Here comes engagement of premium clients and attractive investors from Germany and Dubai making a proper combination.

Whether you are from e-commerce, digital service, consultation or engineering background, your dream to start company in Dubai from Germany can achieve unmatchable scalability.

Additionally, Expo City 2025 and Vision 2030 are growth opportunities for German-owned businesses to thrive in 2026 and future in Dubai.

Perfumes are top choice among Germans, do read perfume business setup also.

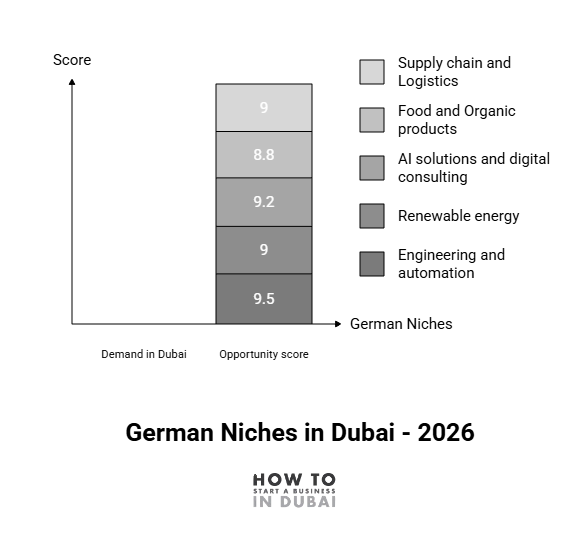

Best German niche to start company in Dubai from Germany that will trend in 2026

Machen wir es Ihnen einfacher to start company in Dubai from Germany. Here is a quick breakdown for you:

| German niche (2026) | Demand in Dubai | Opportunity score (2026) |

| Engineering and automation | Smart City expansion in Dubai. | 9.5/10 |

| Renewable energy like solar and e-mobility | Net zero 2050 target of Dubai. | 9/10 |

| AI solutions and digital consulting | Technology Adoption in fast growing IT field. | 9.2/10 |

| Food and Organic products | Demand for German quality food. | 8.8/10 |

| Supply chain and Logistics | Global trade hub. | 9/10 |

Also do read about available payment gateways in Dubai.

Cost and compliance requirement to start company in Dubai from Germany

Cost and compliance are necessary to be understood that can enhance the motivation and knowledge factor for investors who seek regulatory support and proper idea of business budget.

Here is one quick breakdown:

| Cost and compliance | AED | USD | Compliance requirement |

| Free Zone license | 12,000 to 18,000 | 3,270 to 4,900 | License renewal + activity approval. |

| Investor Visa | 4,000 to 7,000 | 1,090 to 1,900 | Medical test, Emirates ID and biometrics. |

| Office flexi desk | 5,000 to 15,000 | 1,360 to 4,080 | Mandatory license issuance. |

| Company registration | 3,000 to 5,500 | 820 to 1,500 | Incorporating articles and trade name approval. |

| Annual compliance | 4,000 to 8,000 | 1,090 to 2,180 | ESR filing, UBO filing, VAT and accounting. |

Stepwise guidance to start company in Dubai from Germany

“Jetzt ist es Zeit für die Action.” It’s high time once people are getting to know, they start exercising before the positions get acquired.

For entrepreneurs like you too, this is the best time to follow these steps and conquer your deserving place to start company in Dubai from Germany.

| Action | Effectiveness |

| Identify business activity | Business activity identification can support the development of Dubai-Germany strong market alignment. |

| Free zone or mainland selection | Zone selection maximizes operational flexibility, taxation and ownership clarity. |

| Reserving trade name | Speeding up company registration. |

| Document submission | Prevention of approval delay. |

| Office type selection | Minimization of setup and operational cost. |

| Licensing | Licensing through legal operations. |

| Investor visa | Investor visa to secure UAE Residency if required. |

| Opening bank account | Bank account for seamless financial operation. |

| Annual compliance | Protecting business stability and growth. |

Conclusion

Bereit für Dubai? It’s obvious if you keep on learning more to start company in Dubai from Germany you will get to know more add-ons in your knowledge and motivation.

However, to plan right and execute – You need proper guidance for which you need an expert to give you the right path, transparency and a budget-friendly compliance guidance.

Let’s Connect with Us to start company in Dubai from Germany.

FAQs

Q1. Is it possible to start a company in Dubai from Germany without visiting the UAE?

Yes, in the free zone a 100% foreign ownership can be achieved for starting a business in Dubai from Germany.

Q2. What is the minimum investment required for establishing a company in Dubai from Germany?

A minimum of AED 25,000 to 35,000 is required for starting a business in Dubai from Germany.

Q3. How is the corporate tax of 9% in the UAE applicable on a German owned company in Dubai?

Pure foreign-sourced income is kept at 0% however you can still file one corporate tax return to maintain the financial records.

Q4. What banking compliance is necessary for German owners in the UAE?

Banks need to conduct AML and KYC review comprising fund resources, German residential proof, history of international transaction, UBO declaration and invoices for high-risk sectors.

Q5. How is ESR applicable to start a company in Dubai from Germany?

First, you need to file an ESR notification annually with proof of UAE based economic substance and then submit the ESR report in order to avoid penalties of nearly AED 20,000.

Do you need help in business setup or looking to start a business in Dubai? Here you will find all the information and business ideas you need for starting your own company in Dubai.

Leave a reply