You might be struggling in filing accurate VAT Returns — well you are not alone as it is a very new factor in the UAE that has become mandatory since 2018.

Reportedly, Federal Tax Authority (FTA) have launched audits intensively since violations have surged across the sector.

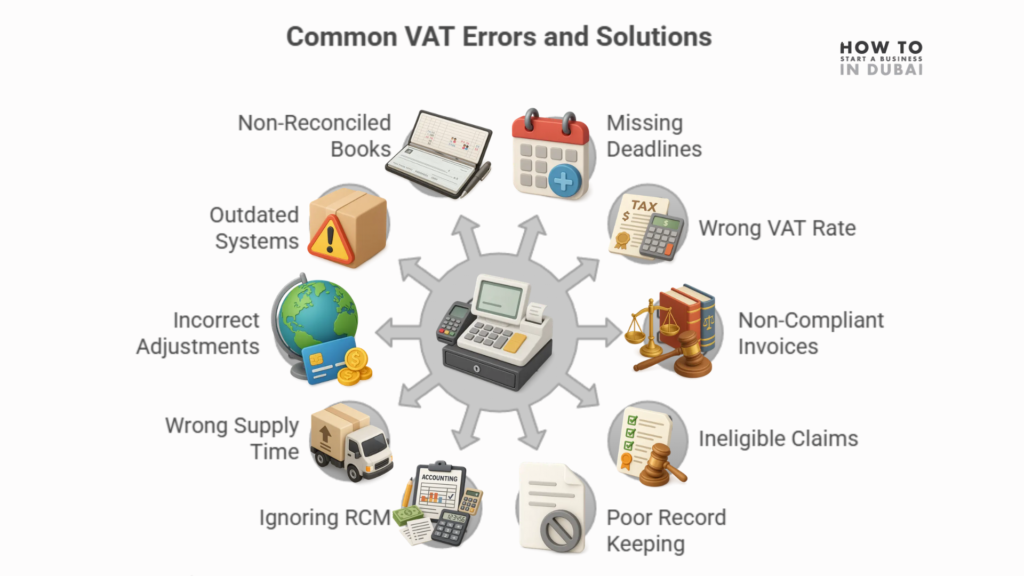

Before it gets more serious let’s focus on the top 10 mistakes businesses make with VAT returns in the UAE.

Missing VAT return deadlines

You should understand that VAT returns mean not to be late in submission as it can cost more than your monthly profit. Delay in VAT Returns appears to be a repeated error among most people.

Now there are fines charging AED 1,000 for your first delay and AED 2,000 for the second along with daily interest on unpaid VAT.

How to Avoid it: Keep automatic reminders to maintain VAT fund reserves and also file early even for your nil returns.

Using wrong VAT Return rate

Do you even know? — a 5% mistake in the wrong VAT rate can cause you 100% penalties. Businesses often confuse zero rated, standard rated and exempt supplies, particularly in healthcare, education service and exports.

How to Avoid it: VAT rate-mapping chart is necessary to stop frequent training and also check of FTA classifications can help to avoid wrong VAT rate consideration.

Interested readers also go for bank account setup procedure.

Issuing non-compliant tax invoices for VAT return

It is totally useless to think of VAT claim, if your invoices are not FTA approved. Sequential numbering, VAT amount, item description and invoices without TRN cause input VAT return unrecoverable.

How to avoid it: Performing audit of routine invoice, VAT compliance invoice template and use standardization.

Claiming ineligible input VAT return

Never get fooled by every receipt as it does not ensure tax benefits all the time. Businesses often claim VAT on employee personal expense entertainment as well as mixed purpose vehicle utility wrongly. These claims get rejected at the auditing period.

How to avoid it: Always claim business related expenses in terms of valid tax invoices.

Poor record keeping of VAT return

Poor record keeping can make you suffer in front of the FTA as they will not accept without proof. VAT laws and documentation need to be maintained for at least 5 to 15 years. Many SMEs lose invoices, rely on spreadsheets and fail in logging adjustment that leads to gaps.

How to avoid it: Utilize structured digital record system and perform through a monthly internal review.

Ignoring Reverse Charge Mechanism (RCM)

Auditors find it as a red flag when imports are delivered without RCM entries. Businesses often make a mistake of importing goods or services while they forget to maintain VAT self-accounting under RCM that leads to understated output VAT.

How to avoid it: Mark all the import transactions and automate RCM software accounting.

Wrong supply time in VAT return

Another mistake is when you put your transaction in a very wrong period. Businesses often incorrectly record supply dates particularly with milestone billing, delayed invoices and advance payments.

How to avoid it: To avoid wrong time of supply for VAT Returns, it is necessary to follow FTA supply time rules and reconciliation for ending transaction period.

Incorrect adjustment in VAT Returns

Never miss your credit note as it can lead to distortion of your VAT return. Always remember that failing in VAT adjustment for customer refunds, discount revision or cancelled invoices can lead to inflated or understated VAT payable.

How to avoid it: In order to avoid the distortion of VAT Returns, you need to issue credit notes via prompt and make alignment with updated VAT entry.

VAT return errors due to outdated accounting system

You are in trouble if the old system is causing new VAT returns penalties. Systems not updated for the VAT rules can cause inaccuracy in the VAT returns. This is particularly in case of zero rated or exempt supplies.

How to avoid it: It will be suitable for you to utilised UAE-VAT enabled accounting tools that can automate calculations and minimise VAT returns tools.

Non reconciliation of books before filing VAT returns

Be worried rather than being feared — your VAT return will simply not survive an audit if your books are not matching. Filing VAT returns in absence of reconciling purchase, sales and bank entries can cause under or over payment.

How to avoid it: Be punctual and perform monthly reconciliation structurally prior to submitting VAT returns.

Final Takeaway: Build a VAT-smart business.

As your final takeaway you must be a businessman responsible enough to maintain your clean VAT Returns.

Here is a breakdown:

- Use compliance software.

- Train your staff regularly.

- Keep complete proof for each entry.

- Reconcile monthly transactions.

- Take support from business consultants.

Conclusion

Maintaining accuracy of VAT returns can assure business protection, compliance reputation and cash flow in the UAE.

Now it’s your turn to perform your VAT Returns.

Well, you might be thinking of the last key takeaway points as it will help you to achieve the above all.

Let’s Connect with Us and solve your VAT returns with the best in the UAE.

FAQs

Q1. What is the deadline of filing VAT returns in the UAE?

VAT returns in the UAE are normally filed quarterly or monthly for big businesses and require submission within 28 days with completion of tax period. Missing VAT return deadline causes penalties of nearly AED 1,000.

Q2. What are the necessary documents required for VAT returns?

VAT Returns require expense record, credit notes, import-export documentation, reconciliation reports, bank statements and tax invoices as FTA requires it to be stored for 5 to 15 years.

Q3. Is it permissible for a business to revise VAT returns after submission?

Businesses are permitted to file voluntary disclosure if they observe any error worth AED 10,000. However, for any short adjustment it can be approved in the next filing period.

Q4. What are the common penalties of incorrect VAT Returns?

Incorrect VAT return can cause penalties for wrong declaration, improper invoicing, invalid Input and late payment. These will lead to daily interest charges, fixed fines and require audit-based assessment.

Q5. How can businesses ensure file compliant VAT returns every time?

VAT compliant accounting system is required for businesses with support of tax invoice verification, monthly record reconciliation, corrections of VAT rates and seeking expert guidance in complex cases.

Do you need help in business setup or looking to start a business in Dubai? Here you will find all the information and business ideas you need for starting your own company in Dubai.

Leave a reply