If you are looking for IFZA Company Setup is one efficient free zone Dubai broadly required for international entrepreneurs, startups and SMEs. However, company registration is the first step.

Starting a corporate bank account is important for regulatory compliance, UAE market credibility and operational readiness.

As per financial sector updates, nearly 65% of the newly registered free zone companies suffer initial delay due to the compliance gap creating structured essentials post IFZA Business Setup.

Eligibility criteria of corporate banking in IFZA Company Setup

UAE based banks come with strict Anti-Money Laundering (AML) and Know Your Customer (KYC) frameworks under UAE Central Bank.

After IFZA Company formation, firms need to follow eligibility standards.

Core eligibility requirements

- Valid IFZA trade license.

- MoA and AOA.

- Director and shareholder passport copies.

- UAE entry stamp and residence visa.

- Proof of contracts and business activity.

- Physical or virtual office lease.

Business risk assessment factors

- Nature of business activity,

- Shareholding structure.

- Country of shareholder origin.

- Expected transaction volume and currency usage.

Read this also If you are from Romania 👉Setting up in Dubai from Romania.

Stepwise procedure of opening a bank account under IFZA Company Setup

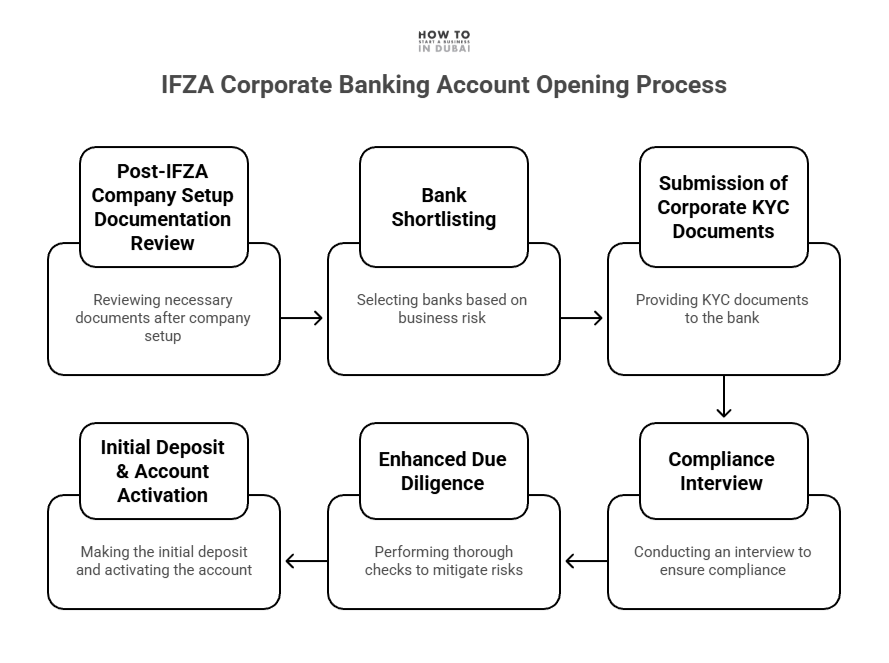

Here is a quick breakdown of opening a bank account under IFZA Company.

- Post-IFZA Company Setup documentation review.

- Bank shortlisting based on activity risk.

- Submission of corporate KYC document.

- Compliance interview.

- Enhanced Due Diligence (EDD).

- Initial deposit & account activation.

Typical timeline

- Low risk activities: 7 to 14 days.

- Medium risk activities: 15 to 25 days.

- High risk activities: 30+ working days.

Also, read about top 5 startups in UAE.

Best banks supporting IFZA Company Setup

IFZA Company Setup requires compliance approval and that facility comes from the following banks.

| Bank name | Account type | Minimum balance | Ideal for |

| Emirates NBD | Business banking | 50,000 | Trading & services. |

| RAKBANK | SME Account | 25,000 | SMEs & startups. |

| Mashreq NeoBiz | Digital Business | 0-10,000 | Freelancers & tech. |

| WIO Bank | Fintech business | 0 | Digital & SaaS. |

| ADCB | Corporate account | 50,000 | Established firms. |

Trend: Note that digital banks like NeoBiz and WIO minimise onboarding time by 40% for IFZA companies with clean compliance profiles.

Compliance risk to avoid after IFZA Company Setup

Banks closely monitor accounts post-activation. In order to avoid closure or freezing, the following are what needs to be avoided:

High risk practice avoidance:

- Mismatch between licensed activity and transactions.

- Unverified international transfers.

- Dormant accounts with sudden large inflows.

- Utilising personal accounts for corporate funds.

- Non-submission of periodic compliance updates.

Regulatory frameworks applied

- UAE Central Bank AML regulations.

- Economic Substance Regulations (ESR)

- Ultimate Beneficial Owner (UBO) rules

Note: Nearly 1 in 5 UAE corporate banks suffer temporary restrictions annually. This is due to onboarding compliance failures.

Conclusion

There is a necessity for IFZA Company Setup corporate bank account with strategic planning, compliance awareness and accurate documentation.

If you are looking forward to getting one corporate bank account for your IFZA Company Setup, then you are in the right place.

Let’s connect with us!

FAQs

Q1. Is it possible to open a bank account immediately post IFZA Company Setup?

A. Yes, proper documentation can immediately help in getting a bank account post IFZA Company Setup.

Q2. Is a UAE residence visa mandatory?

A. Most banks need at least one resident signatory.

Q3. Which IFZA activities face higher banking scrutiny?

A. Consulting, crypto, forex and global trading activities face higher banking scrutiny.

Q4. Can IFZA firms get multiple bank accounts?

A. Yes subject to bank approval and business justification.

Q5. What is the safest startup option?

A. Digital banks with low balance requirements and quick onboarding.

Do you need help in business setup or looking to start a business in Dubai? Here you will find all the information and business ideas you need for starting your own company in Dubai.

Leave a reply